Download the industry report now

Which New Zealand used car providers and car brands are maximising their market share online?

Find out which car providers are taking the lead in organic search and how they’re doing it.

FIRST has investigated the organic search engine rankings for NZ consumer searches focused on used cars and car brands, utilising FIRST’s Ranking Based Reach (RBR) analysis framework. In addition, a consumer survey was carried out to discover what is most important for Kiwis considering purchasing used cars and car brands online.

Analysed websites

Used Cars:

* 2cheapcars.co.nz

* aa.co.nz

* autobase.co.nz

* autotrader.co.nz

* buyrightcars.co.nz

* carfair.co.nz

* drivesouth.co.nz

* trademe.co.nz/motors

* turners.co.nz

Car Brands:

* ford.co.nz

* holden.co.nz

* honda.co.nz

* hyundai.co.nz

* kia.co.nz

* mazda.co.nz

* nissan.co.nz

* subaru.co.nz

* suzuki.co.nz

* toyota.co.nz

In this Used Cars and Car Brands Online Industry Report we discovered:

- Our survey revealed that Kiwis consider price/offers as the most important factor when purchasing cars. This points to the importance of displaying car prices, discounts and other product offers visibly and strategically on the websites of car dealers.

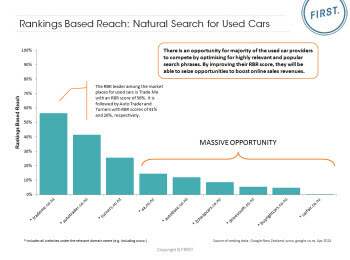

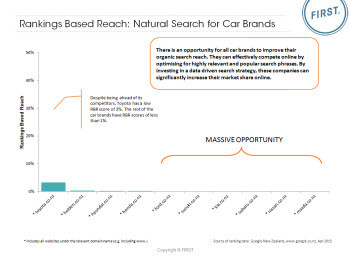

- In the used cars category, Trade Me stands out in the search and ranking landscape followed by Auto Trader and Turners capturing a big proportion of the voice thanks to prominent organic presence. While in the car brands category, Toyota leads in terms of online brand search among New Zealand customers.

- Majority of the analysed used car providers have low RBR scores, below 20%. All of the analysed car brands have extremely low RBR scores, below 5%. Given that, there is significant opportunity for these providers to improve their RBR or search engine reach – for important and popular keywords in organic search.

- Popular search phrases are missing from most sites and in most cases very little is being done with organic search. By improving their RBR score, they will be able to seize opportunities to boost online sales revenues.

- A comprehensive and data-driven digital strategy that integrates both organic and paid search should be a key customer acquisition channel for used car providers and car brands, driving revenue and growing the stores share of digital spend.

Download the industry report now

FIRST uses its bespoke metric called RBR (Ranking Based Reach) to estimate how well each company is ranking in search engines. RBR provides a simple way to compare a website’s search engine rankings with its competitors. RBR is an estimate of the percentage of available search traffic a website will receive for a set of phrases – this gives the sites share of search or reach. It is weighted based on the popularity of each search phrase and the relative click through rate (CTR) of each ranking position.